Mad Catz 1st Qtr 2017 financials continue to paint a bleak picture

Back in February of this year, Mad Catz went through a very rough stretch, having massive turnover with executives and laying off over 60% of their staff. Fast forward to yesterday when Mad Catz released their earnings for 1st Qtr 2017 and updated investors on their restructuring plans. The picture is still bleak, as they took massive losses on the left over Rock Band 4 inventory tied to severing ties with Harmonix along with what appears to be major sales decreases in core products and brands.

Mad Catz leadership continues to blame the Rock Band 4 partnership for the poor results. Per Mad Catz CFO David McKeon, “…Rock Band 4 continues to have a negative effect on our financial performance and we continue to have working capital constraints, we are confident that we can further strengthen our business and deliver a more sustained operating performance for our shareholders by the end of the 2017 fiscal year.”

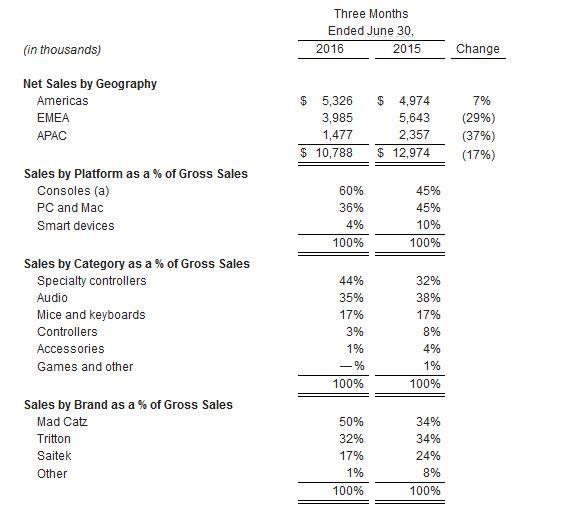

However, the companies sales trends for the past three months seem to paint a different picture as did investors who have continued to hammer what is left of the meager stock price. The Americas are actually did ok with a 7% increase over the prior quarter (likely due to clearance Rock Band 4 peripherals), but the EMEA (European) and APAC (Asian-Pacific) sales were atrocious, down 29% and 37% respectively. Those markets tend to be purchasers of Mad Catz core products such as gaming headsets, fight sticks and specialty controllers, so that has to be a disappointment regardless of how the financials were presented.

With constraints on working capital and slowdown in sales, Mad Catz appears to still be in a struggle to get back to where they want to be if they can avoid bankruptcy. I personally think they should shed some of the more valuable brands (Saitek and Tritton) they have acquired over the years to get back to their core controller and fight stick business. Regardless, take a look at the key points presented to investors and the street:

Key Highlights of Fiscal 2017 First Quarter and Subsequent:

- Fiscal 2017 first quarter net sales decreased 17% to $10.8 million, driven by a 29% decrease in net sales to EMEA and a 37% decrease in net sales to APAC, offset partially by a 7% increase in net sales to the Americas;

- Gross margin declined to (1.0%) from 22.2% in the prior year quarter, driven by $2.7 million of charges related to Rock Band 4 for price reductions with retailers and write-downs of inventory and other assets

- Total operating expenses decreased 31% from the prior year period to $4.6 million as the Company realized the benefits of restructuring activities undertaken during the fourth quarter of fiscal 2016

- Operating loss was ($4.7 million) compared to ($3.8 million) in the prior year

- Diluted net loss per share was ($0.07) compared to ($0.05) in the prior year

- Net position of bank loans, less cash and restricted cash, was $9.4 million at June 30, 2016, compared to $13.0 million at March 31, 2016 and $5.8 million at June 30, 2015

- Sold no shares under the “At-the-Market” (“ATM”) equity offering program

- Announced the initial details of the newest addition to the Tritton audio range: the ARK™ series

- Shipped the “Designed for Samsung” version of the Micro C.T.R.L.R™ Mobile Gamepad

- Shipped the X-56 Rhino H.O.T.A.S. Advanced Flight Control System™, the Company’s newest addition to its Saitek Pro Flight Range of PC-based simulation accessories

- Shipped the Tritton Katana HD 7.1 DTS surround sound gaming headset, the first HDMI-powered gaming headset and a 2016 CES Innovation Award Honoree

- Agreement with Harmonix for Rock Band 4 was terminated resulting in a 120-day wind-down period, ending September 6, 2016, to sell remaining $7.1 million of Rock Band 4 inventory.